Ceybank SavingsPlus : Money Market Fund

| Fund Facts at a Glance | |

|---|---|

| Fund Type | Money Market |

| Investment Objective | Maximize Current Income |

| Invests in | Government & Corporate Debt |

| Dividends | At managers discretion |

| Risk | Moderate - Low |

| Taxation | Refer Government Tax policy |

| Trustee | National Savings Bank |

| Custodian | Bank of Ceylon |

| Management Fees | 0.75% P.A |

| Trustee Fees | 0.15% P.A NAV of the Fund |

| Custodian Fees | 0.050% P.A on the NAV of the Fund (Subject to a minimum of Rs 15,000/- per month.) |

| Front End Fee | Nil |

| Exit Fee | Nil |

| Minimum initial Investment | Rs 10,000/- |

| Currency | Sri Lanka Rupees (LKR) |

| Start Date | 22nd June 2009 |

| Ceybank Savings Plus Fund – Annual Report 2018 |

Introduction

Ceybank SavingsPlus is the first Money Market Fund floated by Ceybank AML. Ceybank SavingsPlus is an Open Ended Unit Trust, to facilitate the general public to reap the benefits of the Money Market in Sri Lanka. An Ideal tool for cash Management

Objective

The primary investment objective of the Fund is to maximise short term current income whilst ensuring ease of liquidity by investing in a portfolio of Money Market Instruments.

Style

The Fund will invest in Money Market Instruments such as Government Securities (Treasury Bills and Treasury Bonds), Bank Deposits, Repurchase Agreements and Corporate Debt Instruments with maturities less than one year.

The Fund will not make investments in listed or unlisted equity securities.

Risk factors

Investors should be aware that the price of Units of this Fund and the dividend paid by the Fund can go down as well as up according to the interest rate fluctuations in the market. Investments in Units differ from Bank deposits and there is no guarantee of any fixed returns.

The Fund's investments are subject to normal market risks and the ability to achieve the investment objectives will depend to a great extent on the monetary policy of the Central Bank of Sri Lanka, overall performance of the economy, and the contributory environmental factors. The Fund is also subject to various degrees of regulatory, fiscal, liquidity, inflation, interest rate and re-investment risks.

Since the investments are denominated in the local currency, the investors in other currencies would have to bear the currency risk as well.

Taxation

Taxes payable by the Fund & the Investor will be based on the prevailing Government tax policy

Dividend

Dividend payable by the Fund is at the discretion of the manager

Dividend history

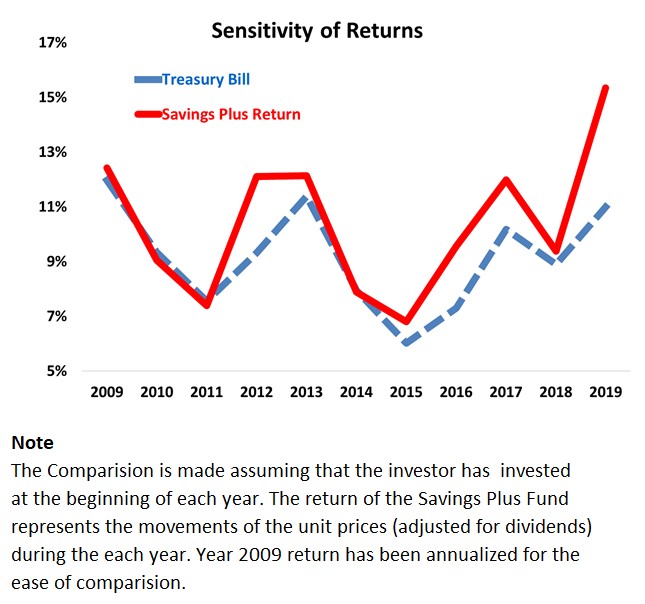

CSP Fund Performance based on NAV

| Period | Yield |

|---|---|

| 2019 | 15.35% |

| 2018 | 9.38% |

| 2017 | 11.98% |

| 2016 | 9.56% |

| 2015 | 6.80% |

| 2014 | 7.89% |

| 2013 | 12.14% |

| 2012 | 12.10% |

| 2011 | 7.39% |

| 2010 | 9.05% |

* Percentage change in NAV as at end December. Adjusted for dividends.

Fees and Charges

| Front End Fee | None |

| Exit Fee | None |

| Management Fee | 0.75% p.a. on the NAV of the Fund |

| Trustee Fees | 0.15% p.a. on the NAV of |

| Custodian Fees | 0.050% P.A on the NAV of the Fund (Subject to a minimum of Rs 15,000/- per month.) |

| Other Information | |

| Financial Year end | 31st December |

| Reporting | Annual and Half yearly |

| Valuation | Daily (Cost plus Accrued Interest) |

| Dividend | At manager’s discretion |

| Trustee | National Savings Bank |

| Custodian | Bank of Ceylon |